How to Buy Foreclosed Homes in Any Market

Home prices have increased steadily of late, making it difficult for investors to break into the housing market, but homeowners are also facing challenges that are opening the door for investors.

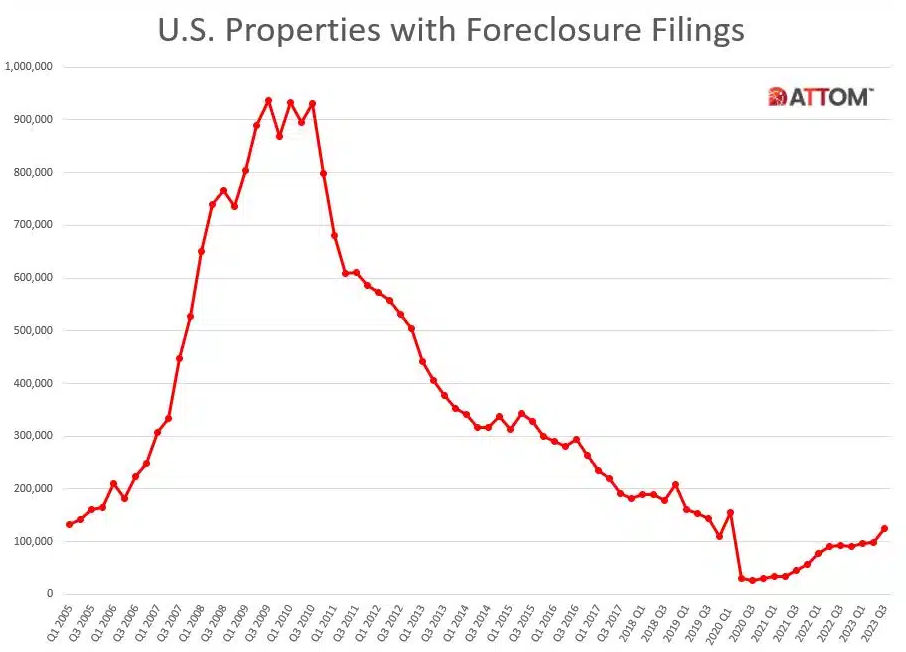

According to the latest third-quarter market reports, foreclosure filings in the US—including default notices, scheduled auctions, and lender repossessions—have increased by 34% compared to the same quarter in 2022.

This increase was most pronounced in North Carolina, Louisiana, Pennsylvania, and Alabama, where thousands of foreclosure filings were recorded.

While foreclosures are unfortunate for the homeowners involved, they can also boost inventory in markets with low supply.

This could mean more opportunities for real estate investors interested in buying foreclosures in their area.

You can purchase distressed properties at below-market value, and sellers are often relieved to be rid of a stressful situation. It’s a win-win for both parties.

Why do Real Estate Investors buy Foreclosed Homes?

Lenders want to recoup their losses as quickly as possible; so, foreclosed homes are often listed at a sizeable discount.

This provides investors with the opportunity to turn a profit.

Real estate cash buyers and other investors who can secure financing at favorable terms have a strong negotiating position in this market, as they can close deals quickly.

Investors can either fix-and-flip the house or turn it into an income-producing rental unit.

How to Buy Foreclosed Homes at Auctions

Although lenders are motivated to sell, most auctions only accept cash payments. Therefore, you will need a fairly large amount of money available to fund the purchase.

If the auction permits mortgage financing, be sure to have your initial approval (in writing) ready, verifying your income and assets.

When you buy a foreclosed home at an auction, you are buying it “as is.”

An appraisal or home inspection is not part of the process.

So, be sure to do your due diligence and speak with a real estate attorney to make an informed decision.

How to Buy Bank-Owned (foreclosed) Properties

Some banks do and some do not work directly with real estate investors or buyers interested in purchasing bank-owned homes.

Banks’ REO (real estate-owned) departments/agents handle the sale of properties that do not sell at auction.

In this case, the bank or lender typically clears the title and ensures the foreclosed house is vacant before you buy it.

Bank-owned houses are sold “as-is” but typically allow for interior viewing and even professional inspection.

You can use online resources like RealtyTrac to locate bank-owned properties. A quick search by state, city, or ZIP code will furnish you with a list of potential leads that you can subsequently explore using REIgrow to connect with motivated sellers.

How to buy Pre-Foreclosures from Homeowners

When you eye foreclosed homes at auctions or plan to purchase them via REO agents, you will naturally face stiff competition from other buyers.

Seasoned real estate investors proactively build their lists of pre-foreclosure properties to find potential deals that align with their overall investment strategy.

To start building your list, pull in data on pre-foreclosure homes from the MLS (multiple listing service) or foreclosure.com. These are typically cases where homeowners have received default notices.

You can also get some data on pre-foreclosures from your county and local courthouse buildings.

Now, the property may never go on sale. Or, the current homeowner may be motivated to sell –

- To get out of financial distress

- To avoid foreclosure proceedings that could hurt their credit history and future prospects

- To get out of a stressful situation

You’ll need to reach out to find out.

To close deals before civil foreclosure proceedings begin, it is essential to reach out to these sellers early on. Homeowners typically have four months to find a solution after missing the first mortgage payment.

This is where all-in-one real-estate investment marketing platforms like REIgrow can help.

Tailored to real estate investors (and their employees, if any), REIgrow helps you manage leads and launch automated marketing campaigns to reach out to homeowners who may be motivated to sell residential real estate to avoid foreclosures.

How to Buy Pre-foreclosures through ‘Short Sale’

In a ‘short sale’ transaction, the homeowner sells the house for less than what they owe on the mortgage.

Many short sales are pre-foreclosures, as homeowners try to avoid foreclosure filing.

If the homeowner still holds the title, you can work with their attorney to make an offer.

However, the lender must approve the offer; this can be challenging at times because banks may take months to respond to your short-sale offer.

Buying Foreclosed Homes at Sheriff’s Sale Auction

When a homeowner defaults on their mortgage, the lender may enlist local law enforcement to auction off the property on the courthouse steps to the highest bidder to recover the loan.

The date, time, and location of sheriff’s sale auctions are typically publicized through local newspapers and online platforms.

Buying Government-Owned Properties

The government may take possession of a house if it was purchased with a loan guaranteed by the US government’s Federal Housing Administration (FHA) or Department of Veterans Affairs (VA).

When these properties go into foreclosure, they are typically sold by brokers on behalf of the government agency.

You can find a list of registered brokers who manage the sale of government-owned foreclosed homes on the website of the Department of Housing and Urban Development (HUD).

Secure Funding for Foreclosed Homes in Advance

Funding sources may include your savings, cash flow from rental properties, proceeds from a recent deal, private lenders (such as family and friends), hard money lenders (such as other investors in your market), and traditional lending institutions.

Foreclosures often progress at a rapid pace, so you should have your financing strategy fully sorted out before you begin searching for foreclosed or pre-foreclosed properties to purchase.

If you have to wait several weeks to secure financing, you could lose your negotiating leverage and miss out on deals.

Investing in Foreclosures: Look Before You Leap

When you are buying these properties from homeowners, banks’ REOs, or through short-sale, you will typically have the option to get the property inspected.

A professional inspection will help estimate the funds required for necessary repairs to restore the property to its market value.

This way, you can determine the maximum offer you can make while still ensuring a profitable investment.

You should also inspect the property for squatters if it has remained vacant for an extended period. Squatters can be legally evicted, but it’s better to avoid such a challenging situation.

Evictions can be a lengthy process, spanning months or even years, and they often entail substantial legal fees, costing you thousands of dollars.

Foreclosed homes (other than REO homes) may have unpaid liens, outstanding taxes, and other such issues that new owners have to deal with. So, it’s a good idea to run a title search to reveal hidden debts and other issues.

Final Words

Tapping into foreclosed homes or preforeclosures is one of the best strategies to grow your real estate investment business.

Once you have considered the potential benefits and drawbacks of investing in a property, and are confident that you can complete the repairs on time and make a profit, you can submit an offer.

To find the best deals on pre-foreclosures, stay organized and use a dedicated REI system to avoid wasting time, energy, and resources, and to prevent leads from slipping through the cracks.

If you haven’t already, start a free REIgrow trial to boost efficiency in lead management, nurturing, and multi-channel marketing through built-in automation tools.